Peer to Peer Lending: Using technology to bridge the ‘credit gap’

Fintech (or Finance+Technology) has disrupted the personal finance space in a big way. For instance, the age-old practice of Lending is witnessing the undermining of the intermediary financial institution (Bank) by cutting it out from the Lending chain, as the middleman, with the help of technology.

One of the significant sources of revenue for any Bank is its ability to lend funds at a rate of interest higher than its cost of funds. Such amounts lent by the Banks are considered its assets, which help the Bank in generating a steady stream of income. Peer to Peer Lending or P2P Lending has opened this investment domain for one and all, by enabling an Individual owner of funds (read Investor) to lend directly to individuals or companies, and to create large pools of loans (read Interest-bearing assets). The P2P platforms play a role in risk mitigation by pre-verifying the prospective borrowers before listing them.

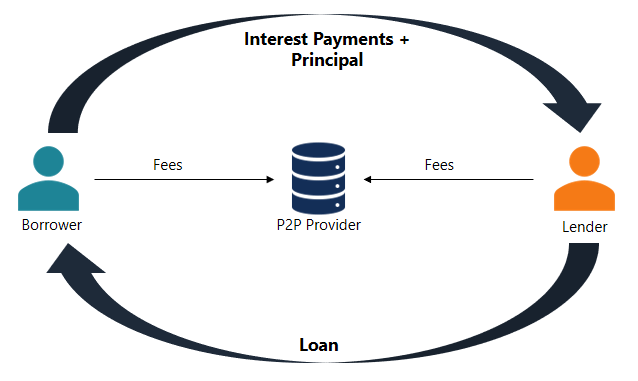

Simply speaking, the P2P platforms act as a ‘marketplace’, bringing together the owners of funds (lenders) and the prospective borrowers and matching the aspirations of the lenders (return expectations) with that of the profile of the borrowers. The entire process is fully automated by integrating in their algorithm various technological aspects like Big Data, Artificial Intelligence and Machine Learning and deploying the same in credit evaluation mechanism along with physical verification for in-depth screening of lenders and rating them on a certain risk matrix, based on their profiles.

All information about the Borrowers is mentioned and is accessible by the Lenders (Investors) on the platform and provides them with a list of pre-verified individuals and businesses who need a loan – personal or business loan. The Lender can then select the borrowers meet their criteria and finance their loan requirement. The borrower then starts making EMI repayments that obviously will include a part of the principal amount and the interest. This is how the Lender gets payments every month that actually open doors to month-on-month returns and an alternative income source until the loan is fully repaid.

There is a large population of unbanked Indians who are not able to access loans from organized sector. A huge population of underserved Indians also face loan rejection from banks due to reasons like bad, poor or no credit history. As a result, so many honest, reliable and creditworthy borrowers cannot get loan when they need it the most. P2P Lending platforms make it possible for them to access funds, thereby helping bridge the credit gap in the economy. Typically the P2P platforms allow borrowers to access credit at interest rates between 9.99%p.a. to 36+% p.a. while lenders can earn gross returns from 9% to 18+% p.a. However, it is important to note that such loans (offered through P2P portals) are ‘unsecured’ in nature and carry reasonably high rate of default, as compared to the bank-initiated loans.

P2P Lending has been accorded an NBFC status by the RBI, in 2017. Under the RBI Directives, the P2P Lending platform has to obtain a ‘certificate of registration’ which is awarded to those with net-owned funds of Rs.2 crores or higher. The prescribed leverage ratio should not exceed 2 (to keep under check their indiscriminate growth). Moreover, the P2P platforms have to periodically report their financial position to the RBI. Collectively, all this is building credibility in the P2P Lending sector.

Resultantly, the emerging P2P Lending industry has seen early adoption in a short span of time, offering Investors an alternative source of income-generation and durable source of funding to the unbanked – businesses and individuals.

Indians have been relatively underserved with regards timely and sustainable credit and the credit gap in the country’s small and medium business stood at a staggering $240 billion in August 2019 and the gap seems to be widening every year. Historically, the demand for credit has far outstripped supply and banks alone have been unable to solve the widening credit gap and hence there is an urgent need to employ a number of financial tools and offerings to plug the gap. Fintech can play a huge role and especially P2P platforms, after having been accorded an NBFC status, can be crucial.

From Investors’ perspective, pursuing lending through P2P platforms represent an alternative asset class, enabling portfolio Diversification. Such an investment offers a stream of Regular Income, at a rate higher than that of typical fixed income instruments like deposits and bonds. The tenor of loans extended can be controlled by the respective Investor thereby managing his/ her Liquidity requirements. However, this comes at a reasonably higher risk of Default by the borrowers whose credit profile may be below par.

Conclusion: In its present avatar, as a regulated industry, P2P Lending does not even have a 5 year track record. More data is required to be analysed to establish the efficacy of the proposition and sustenance of the industry on the whole. Risk-averse investors should stay clear of investing in this proposition, while those with appropriate risk-appetite may start by learning more about it before making an allocation!

Table of Contents